The Weekly Distillation No.58

Markets; Leadership; Freedom; Censorship; Tokens; Quantitative Tightening; War; Bears

This newsletter is written for entrepreneurial leaders who want to understand the moment we are living in, see the key themes, and create better solutions to advance their mission. I write about a broad range of topics with the connecting questions being what is happening, the trends, and what it means. You can read more about the key themes I see here.

People once said…………..

“Thanks to our collective efforts to stop Omicron spreading, case rates are slowing and so it is possible to resume a measured and proportionate return to hybrid working.” - Kate Forbes, Finance Minister for Scotland

“Wars are always madness: all is lost in war, all is to be gained in peace.” - Pope Francis

“The military don't start wars. Politicians start wars”- William Westmoreland

“We’re going to stage a comeback the likes of which nobody has ever seen.” - Donald Trump, who then later declared himself as the 45th AND 47th US President.

“Whenever you find yourself on the side of the majority, it is time to pause and reflect.” - Mark Twain

“Censorship reflects a society's lack of confidence in itself.” - Potter Stewart

Skim it in a minute

Last week I wrote about how everything seemed blurry. The phrase in my head right now is ‘inflection point’. Will the markets stabilise and rise, or will they continue to plummet? (Spoiler alert - there is no investment advice in this newsletter). Will the Ukraine and Russia standoff calm down or escalate into a hot war? As more people in the West return to the office what kind of culture and leadership might we expect? Have we reached a final turning point on Covid?

Return of the Mac Market Crash

The current financial markets crash is, I believe, the eighth I have seen in my life.

In 1987, a hurricane ripped through Southern England and many traders were stuck at home, lowering liquidity in the markets. The Dow fell by 22% in a single day (read that again Bitcoin fans). Prior to the crash the market had risen by 69% that year.

In 1997/98 the Asian/Russian crisis hit. Over-leveraged growing nations, combined with aggressive currency speculation, led to collapse in economies and stockmarkets and the hedge-fund Long-Term Capital Management (those last 6 words are surely an oxymoron)

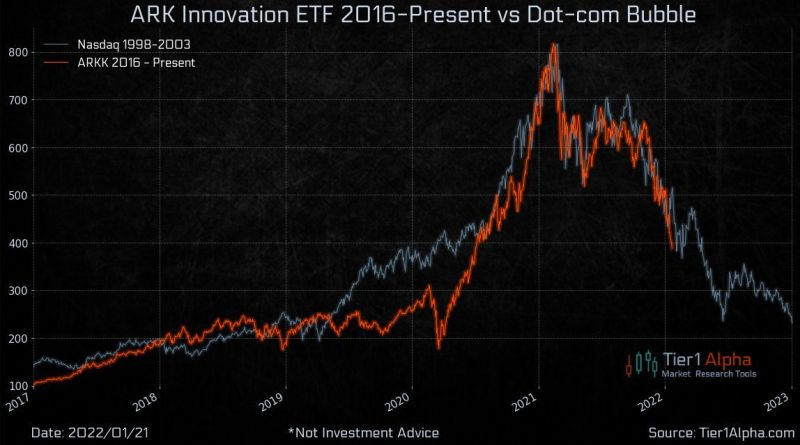

In 2000, we saw the unwinding of the dotcom boom, with tech and high-growth stocks falling by as much as 99% in the following 2 years.

In 2001, the markets crashed following 9/11

In 2007, they crashed again as the financial crisis became a reality, a reaction to the property bubble imploding. Over the next 2 years the Dow falls by more than 50%, as do many other indices. Related to this was the European Sovereign debt crisis in 2010.

In Q4 of 2018, the Dow fell by 18%, with Bitcoin falling by 45%.

In 2020, the S&P500 fell by 34% in a month as a response to the arrival of Covid.

And now, in 2022, we have the great realisation of inflation and tightening hitting us at the same time.

Five lessons

Lesson 1. Crashes happen. This is a regular occurrence of any financial markets as human psychology shifts from fear to greed and market participants (traders) benefit from higher volatility. If you don’t like volatility, buy a piggy bank.

Lesson 2. Every one of these crashes relates to an unexpected piece (or pieces) of information changing the expectation of the future (Covid, 9/11, economic crisis, interest rate tightening, mortgage market collapse). Many of these were impossible to see in advance.

Lesson 3. Know if you are a trader or an investor. These, in my experience, are two very different personalities. You’re either good at winning money at poker or you are not. I’ve always been more of an investor than a trader and therefore know what space I have to play in.

Lesson 4. Crashes pass and over the long term (100 years+), equities have still been a good place to put your money.

Lesson 5. Even professional investors can lose half of their money in weeks. Hindsight investing is not a strategy.

Why now?

At its simplest, the markets are moving from risk-on (crypto assets, tech stocks, equities, biotech etc.) into risk-off assets (dollars, Swiss francs, value stocks, T-bills are usually the favourites). However, at a more fundamental level, the value of future cash is seen as less than the value of cash now. This is happening for 3 main reasons:

Inflation is rising, meaning a $ in 10 years will buy you less than you thought it would a year ago.

Interest rates are rising in response. If a year ago you could get 0% for money in the bank now, and 10% annualised return from a long-term equity investment, and now those ratios look like 1% and 10% then rational buyers will move some assets towards the 1%. Which means markets sell long-duration assets (high-growth, tech companies, many crypto and de-fi plays, biotech) and buy short-duration assets (companies paying dividends, food producers, bonds, cash in bank etc). As an aside, UK Government interest payments were £8b.1bn last month, up from £2.7bn the year before. That’s largely because of more debt rather than higher rates but worth keeping an eye on. As rates rise, markets are now predicting a coming recession (albeit they have historically done this up to 2 years in advance of a recession actually arriving).

Quantitative Easing (QE) is turning to Quantitative Tightening (QT). My analogy this week was of a bath. Water coming into the bath is more money buying assets, and water going out of the bath is less money to buy assets. The water is assets and the level of water is the appetite (and hence valuations) for those assets. I saw the chart below this week, posted by a top VC, showing how US startup valuations (across 6000 deals, have risen in recent years regardless of stage.

The speed of the water going around the bath is the volatility of money. QE began in the financial crisis of 2008 and the four main Central Banks (US Federal Reserve; Bank of England; European Central Bank and the Bank of Japan) have added $10.1 trillion of assets purchased to their balance sheets since 2014 alone. That’s a lot of water that flowed into the bath. As QE has reinflated the bath, water levels have risen (valuations). QE is now coming to an end and markets believe we are about to see QT as well, where central banks don’t just turn off the tap, they also open the plug. Some assets and countries are in a shakier position than others when this happens.

So what about your house price? Your holdings of rare whisky? Your pension or your crypto holdings? Well, this isn’t an investment advice newsletter so you’ll have to work that out elsewhere. I have no desire to end up in jail.

The bear case I wrote about two weeks ago is a lot closer to coming to pass than it was then. That doesn’t fill me with any joy.

The calm before the Ukrainian storm

It still appears as if we are heading for a significant war in Europe in the near term. “Truth is the first consequence of war” is a classic quote of conflicts but it is rapidly becoming apparent that somebody is lying. Russia says “we won’t invade”, Ukraine says war is no more likely than it was this time last year and the US says Russia could likely invade in February. Russia has now moved troops into Belarus, opening up another angle of attack. It is worth remembering that looking at history through a cyclical lens, we are due a major rupturing of Western society that tends to happen every 80 years or so. As I talked about 2 weeks ago, there is a bear case for 2022 that makes it a worse year than 2021 - which was far from people’s minds at the start of January. Even if Russia walks away this time, surely it will return to the same place next year when it wants more concessions (the approach of any typical bully). Putin aspires to great wealth and great power - with the power being demonstrated through the creation of “Greater Russia”. It’s hard for him to get there without going through Ukraine. Ken Follet’s recent novel “Never” looks at the question of could the world again sleepwalk into a full global conflict, the way it did in WW1. It is surprisingly easy and the lessons for what seems like a localised conflict are clear. Blessed are the peacemakers indeed.

A leadership dilemma

Monday will mark a return to the office for many people in Scotland, as Government advice moves to advising a hybrid approach to working. Buses in my city are returning to full service and many will be dusting off their best work clothes this weekend, after almost 2 years of being advised to work from home.

But do people want to return to the office? I had a hybrid pattern pre-Covid due to my role but if anything, will be in the office more than I was previously. This (non-scientific) BCG poll suggests workers want to continue to work mostly away from the office. What does this say about your organisation’s culture or office environment? In some cases this translates to a work-from-anywhere or live-from-anywhere approach as Brian Chesky is taking.

However, think of it from an employer’s perspective. It is incredibly hard to have visibility on whether or not your team is being productive. There will be some people that are over-working and others that are under-working that are both being rewarded in the same way, which feels far from fair. Collaboration and culture building are almost impossible in a fully remote team. Communicating difficult and challenging messages is better done in person, as is communicating empathy and listening to your team. It’s easy to lose energy, get distracted or simply lose time due to turnaround requirements from people who are not in the same room as you. There are a lot of good reasons to get people back in the office.

Even still, there is clearly a conflict between where many employers sit and how most employees feel about this transition. This will be a very easy environment for companies to poach staff simply by offering a better package of work-life balance. In the last 2 months I have had at least 3 conversations with people in my city who are seriously contemplating moving firms simply because they can work for them remotely.

In a week that may determine the Prime Minister’s future, the return to the office will see many leaders out of their depth on how to adapt to the changed expectations of the worker, and frustration on both sides due to low levels of communication and unrealised expectations.

I’ve said throughout the last two years that unless there is an intentional move to a new way of working, we will simply default to the old models, and that is what many firms appear to be doing. How many CEOs have sat down with their teams and listened? How many employees are actually taking on-board the concerns of the employer? Commuting, in-office work and traditional measurements of performance seem to be the norm for many firms.

This creates a fantastic environment for innovation - the employee who creates a new role elsewhere, the employer who can build a new approach to organisational culture or a collaboration of imagination on environments, measurement, leadership and communication. I remain both a pessimist (for most office based firms) and an optimist (for the creative, the edgy, the boundary-pusher) for the future of work.

In coming years will there be even more of a blurring between leisure and work? Will we get paid to play, find rest in work and be an investable asset?

“Remote work makes the office even less visible. And flexible work makes the boundaries of the corporation less distinct.

But change does not stop there. It is not just where or when we work that is changing; it is the nature of work itself. For a growing number of people, work is becoming indistinguishable from leisure. In some cases, the workers don't even know they are working. In others, workers think they are working while they are, in fact, resting.”

A free Europe?

The consensus in the UK is now that we seem to have passed the worst of Omicron (albeit cases are plateauing due to the rise in children and greater socialising) and that Covid will be endemic and restrictions will be almost entirely gone within weeks. In England they are largely all gone already. What does it look like to live in the new normal? The tweet thread above points to vaccines plus treatment plus immunity meaning we have reduced the threat almost entirely.

Technology is forming Western Society

Two interesting aticles in the tech world. One from this platform, Substack, on how they are standing up to platform censorship as a default strategy, a helpful approach. The other on tokens. Both worth thinking on.

Thanks for reading. Last week’s newsletter received 782 views and the number of subscribers is now at 207, with a 68% open rate. I’ve been in discussions about whether to “niche down” on what I write about and if so how - I’d love to hear your views on this.

If you liked this week’s newsletter, please forward it to someone else. If you are a regular reader, please think about subscribing (it’s free) and receiving The Weekly Distillation straight to your inbox. Have a great weekend.